Leading adviser platform and DFM provider Parmenion today announces it has added new open banking functionality to its platform. Through a new partnership with Payit™ by NatWest, it will now be even easier for clients to invest.

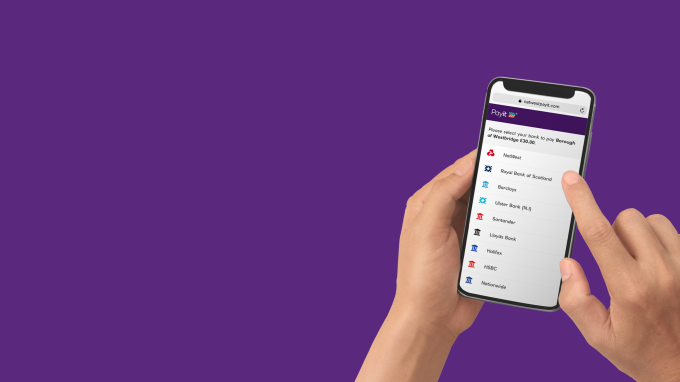

Initially, clients will be able to top up their accounts through Payit™ - an award-winning open banking technology1 from NatWest. Payit™ enables quick and easy top-ups through the online bank of a client’s choice using a QR code – they don’t have to bank with NatWest to be able to use it, and they don’t need a mobile banking app - the tool also works with online banking. This service will be expanded to include other types of payments, all with the aim of making life easier for advisers and their clients.

Later this year, Parmenion will further enhance usability to give clients more self-service capability – putting more power in the hands of the client, and removing the administrative burden from advisers. Parmenion also continues to improve its client reporting – giving advisers the flexibility to tailor reporting for their clients. This is alongside the introduction of tiered adviser charging – helping advisers charge for their services in the way they want to.

Parmenion Chief Marketing Officer Sarah Lyons commented:

“We want to make it as simple and intuitive as possible for people to top up their investments whenever they like. As strong believers in the power of technology, we wanted to embrace the Open Banking revolution to make top ups even easier by adding the Payit™ tool to the platform. It’s also important not to exclude clients who may not be as comfortable with online and mobile banking, so of course we will still allow investment account top-ups via the traditional methods of bank transfers and cheques.”

Ritu Sehgal, head of transaction services and trade at NatWest said:

“We are delighted to help Parmenion leverage the benefits of open banking through Payit by NatWest, enabling clients to top up their investment accounts in a simple and streamlined way. By giving their IFA’s access to the service, Parmenion’s customers can add funds quickly to their accounts whilst ensuring a secure transaction.”

About Parmenion

Launched in 2007, Parmenion is a rapidly growing, award winning technology and investment solutions business.

Our strength comes from seamlessly integrating three core disciplines: discretionary investment management, platform services and intuitive technology.

Our unique, integrated offer makes it easy for financial advisers to operate a centralised investment proposition. By doing all the heavy lifting, we provide scalability and reduced business risk, leaving them to focus on what is important - developing their client relationships.

The value of investments under our management is now in the region of £9bn. More than 1,500 Adviser firms have selected us as their partner to deliver their chosen investment proposition to over 70,000 underlying clients.

1 FF Banking Tech Awards 2023 Best Use of Tech in Payments and Payments Awards 2024 Open Banking Initiative of the Year

*You will need to sign up to Payit™ terms and conditions and you may need to hold an account with us. Your business must be based and trading in the UK with a turnover above £2M. You must be 18 years or older. Fees apply.